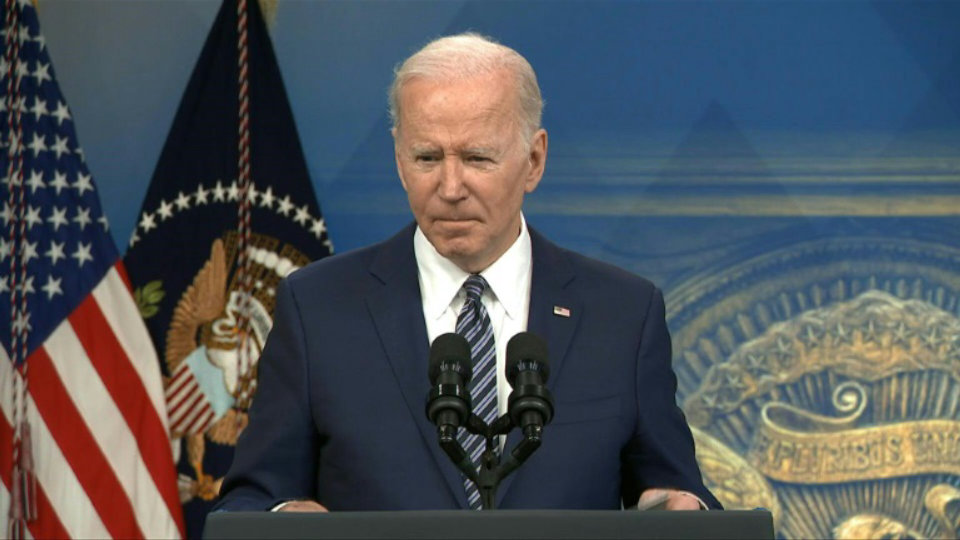

President Joe Biden will announce Thursday a record release from US strategic oil reserves in an attempt to curb a politically damaging surge in domestic fuel prices following Russia’s attack on Ukraine, the White House said.

The measure will dump a million barrels of US government oil a day for six months onto the overheated global market in hopes of dampening inflationary shockwaves ripping through the American economy.

“The scale of this release is unprecedented,” the White House said in a statement. “This record release will provide a historic amount of supply to serve as bridge until the end of the year when domestic production ramps up.”

Struggling with bad poll numbers and November’s looming midterm elections, when Republicans are forecast to take over Congress from the Democrats, the White House is scrambling to show Americans that Biden has a solution to a problem rooted in aftershocks from the Covid pandemic and President Vladimir Putin’s brutal war.

Biden was scheduled to address the nation on his plan, which will augment global supplies by about one percent, later Thursday.

Oil prices fell sharply even on initial reports of the plan, which came as the OPEC+ group of petroleum exporters decided to raise output only modestly despite the jump in crude prices in the wake of key energy supplier Russia’s decision to invade Ukraine.

A senior US official told reporters that the US oil would be “coming to market very soon” and that with other countries making their own coordinated releases of reserves, the total addition to daily supply will be “well in excess of the one million barrels.”

Fallout from Russia sanctions

The release dwarfs earlier uses of the strategic stockpile announced by the Biden administration in tandem with other countries on March 1 following the Russian invasion, and also last year in response to rising inflation.

Despite a strongly rebounding economy and rapidly receding Covid-19 pandemic, Biden is getting little credit from voters, who instead blame him for rising prices everywhere from the supermarket to car dealerships.

Supply chain snags related to the different pace of economic recoveries around the world are part of the inflation phenomenon. Also underlying the politically perilous trend, however, are ever higher fuel costs, which in turn push up prices for transport of almost all goods.

And for US motorists, the price shock as they fill cars in gasoline stations is a constant irritation. “I did this,” reads a sticker featuring a picture of Biden that has been fixed next to pump handles in many stations.

Gasoline prices currently stand at an average of $4.23 a gallon, up 47 percent from their level a year ago.

The price of US benchmark West Texas Intermediate was down 4.6 percent to $102.89 a barrel, while Brent oil futures were down 5.5 percent at $107.20 a barrel.

Oil prices surged close to $140 a barrel in March. Prices have retreated somewhat since the United States banned Russian energy imports on March 8, but have lingered above $100 a barrel most of the subsequent period.

The senior US official, speaking on condition of anonymity, said that prices paid by motorists “right now are up almost $1 since Vladimir Putin accelerated his military buildup in January.”

The official said this was directly linked to the US oil sanctions on Russia but said the measure had been “the right thing to do.”

“Russian oil supply is dropping and the price has increased. The president has said from the start that standing up to Putin’s aggression would never be painless, but he is committed to doing everything he can to help American families,” the official said.